excise tax calculator sanford maine

Youll be taken to a page for all years of the particular vehicle. The calculator will show you the total sales tax amount as well as the county city and.

Maine Sales Tax Calculator And Local Rates 2021 Wise

Monday - Thursday from 730 am.

. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. The 55 sales tax rate in saco consists of 55 maine state sales tax. Select the year of your.

This calculator is for the renewal registrations of passenger vehicles only. The excise tax you pay goes to the construction and. The Sanford Maine sales tax is 550 the same as the Maine state sales tax.

Mil rate is the rate used to calculate excise tax. Enter your vehicle cost. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

- NO COMMA For. Departments Treasury Motor Vehicles Excise Tax Calculator. How 2021 Sales taxes are calculated in Maine.

How much will it cost to renew my. Under Used Cars select the make and model of your vehicle and click Go. As of August 2014 mil rates are as follows.

You can use our Maine Sales Tax Calculator to look up sales tax rates in Maine by address zip code. Official Website of the Town of Hampden Maine Town Office Hours. Excise Tax Calculator Bar Harbor Maine.

State has no general sales tax. Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen. 207 324 9115 Phone 207 324 9122 Fax The Town of Sanford Tax Assessors Office is located in Sanford Maine.

The rates drop back on January 1st of each year. To calculate your estimated registration renewal cost you will need the following information. This calculator is for the renewal registrations of passenger vehicles only.

YEAR 1 0240 mil rate YEAR 2. Contact 207283-3303 with any questions regarding the excise tax calculator. Sanford Maine 04073.

Visit the Maine Revenue Service page for updated mil rates. Assessor of Taxes - TOWN OF WARREN The state general sales tax rate of Maine is 55. First you will need the Manufacturers Suggested Retail Price MSRP for your vehicle.

Navigate to MSN Autos. 106 Western Ave Hampden ME 04444 Phone. MSRP is the sticker price of.

Sanford Colorados Sales Tax Rate is 29. While many other states allow counties and other localities to collect a local option sales tax Maine does not. Maine Land for Sale.

6 hours ago Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicleEnter your vehicle. Collects excise taxes for motor vehicles and recreational vehicles as well as registering those items for.

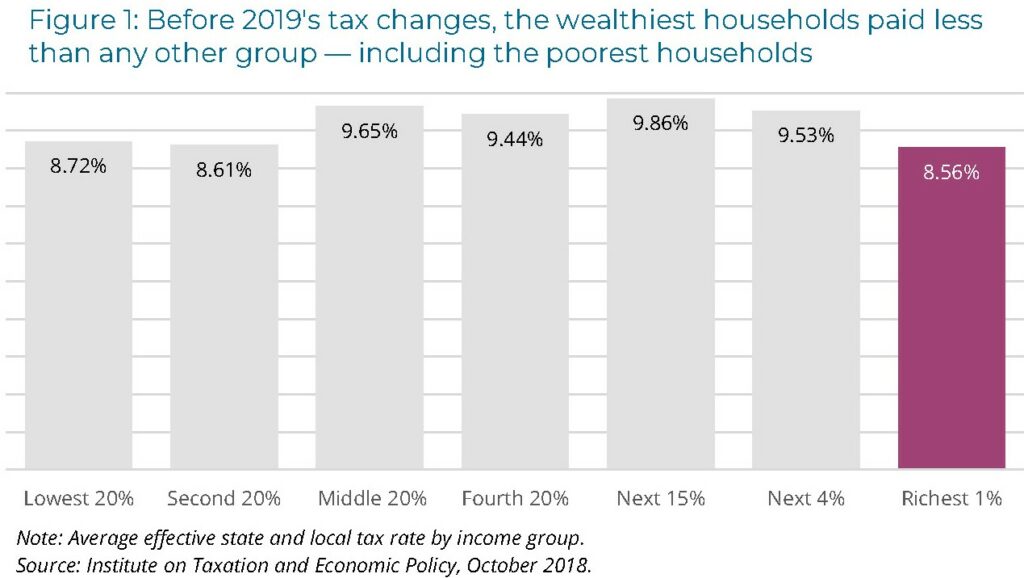

Maine Who Pays 6th Edition Itep

Maine Property Tax Rates By Town The Master List

Maine Vehicle Sales Tax Fees Calculator

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Transfer Tax Calculator 2022 For All 50 States

Maine Car Registration A Helpful Illustrative Guide

Maine Reaches Tax Fairness Milestone Itep

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

State Income Tax Rates And Brackets 2021 Tax Foundation

Motor Vehicle Registration The City Of Brewer Maine

Maine Auto Excise Tax Repeal Question 2 2009 Ballotpedia

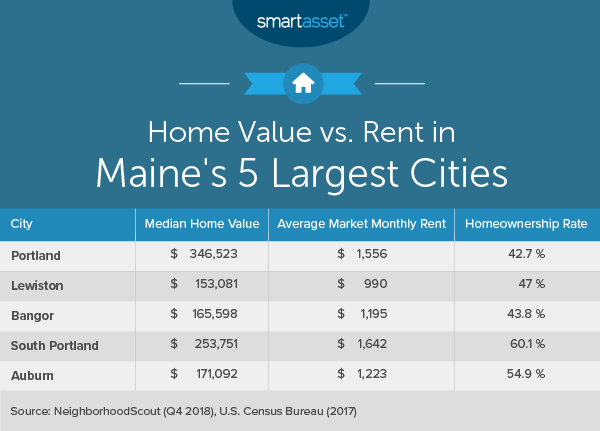

What Is The Cost Of Living In Maine Smartasset

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Welcome To The City Of Bangor Maine Excise Tax Calculator

How To Calculate Cannabis Taxes At Your Dispensary